21 minutes

#00 – Vires in Numeris

A few Fridays ago I sat with Vincent to chat about his experience as a developer and CTO within the Bitcoin universe. If you are new to this and never heard about Bitcoin, imagine Bitcoin as a network of users sharing code that does one useful stuff: create and transact digital scarcity.

Basically it is very much like gold, but on the Internet.

The discussion touched the following themes:

- A Bitcoiner Story

- The Fall of Bitcoin

- Antifragility

- Mexican Standoff

- Interlude

- Empiricism Versus Theory

- Am I Crazy?

- A Lie Detector

A Bitcoiner Story

Can you introduce yourself and what lead you to Bitcoin ? What made you fall in the rabbit hole ? What were the steps, do you remember ?

The first time I heard about Bitcoin was a very long time ago. First time was in 2011. I came here in 2012 already knowing about Bitcoin. Back then I was following a lot of tech news and news related to the universe of “internet freedom”. Bitcoin stood out already. No one had a clear idea of the potential but people were already discussing it on the forum where I participated. It’s when I came in Montreal that I met people who were in this world. I got more interested and started playing with it.

Did you approach it like a technical curiosity or as an investor ?

It was a bit of both. I wanted to use it as money and see how it works. I went to meetups and met several people. This was the starting point and I started working on several projects.

All related to Bitcoin ?

Most of them, yes. Some had a broader scope like blockchain consulting in the enterprise world. I worked for exchanges. I explored a few prototypical projects in traceability as well. My interest has always been in permissionless blockchains, in particular Bitcoin. I also looked into Monero because privacy is important to me. I used to follow the community and experiment with it. I also looked into other technologies, such as Grin and MimbleWimble. However my focus remains with Bitcoin.

At first I started with Bitcoin as a curious, then at some point I thought to myself “Wow the implications are much larger than what I envisioned”. Did that happen to you too ? Or is it just me ?

Yes and no. At first in 2011, 2012, 2013, Bitcoin was a bit underground. It was used on the darkweb and the main added value was censorship resistance : no one can prevent you to transact. It is not anonymous like many learned at their expenses but it is close to something like cash but on the Internet. This is something that never existed before. One big other feature was the monetary policy. Back then the idea that it would fight against central banks was already present. Even though there were lots of divergences.

There was also the phase of improvements with altcoins where people thought of generalizing the blockchain idea. The projects mostly failed. You look ten years later to what is left and you see we finally come back to the basis, what was already there in 2011.

What makes Bitcoin valuable are those two features : censorship resistance (no transaction can be stopped) and a precise monetary system where you can predict how much bitcoins will be created. No manipulation by a central entity is possible.

Those two features are part of the core of Bitcoin : Bitcoin is a permissionless peer-to-peer network and a fixed monetary policy.

There also are many other characteristics. But those two are primordial. In one’s journey in the crypto universe, there are several phases : exploring Bitcoin, then altcoins or blockchains at large, but there is always a moment where you come back to Bitcoin. That’s because you see that the real fundamental value is in those characteristics. It is hard to generalize it. Smart contracts trying to generalize the censorship resistance to everything are good in theory. Those are potential use cases but in practice, it does not work.

Like with Ethereum nodes that are becoming too bloated. This leads to centralization because running a full node is slowly becoming too much of a burden for the users.

It’s the mix of many things : it does not work and people do not need it. Money is a special use case where there is real value for people to be able to exchange freely and do transactions. Take Cryptokitties for example, censorship resistance for that has less utility. Hence, the trade-off between censorship resistance and loss in efficiency (and exposure to potential bugs) is not interesting anymore. If you remove the monetary feature, the trade-off of using a blockchain is not worth paying. With a blockchain you lose in efficiency to gain censorship resistance. Most of the applications do not need that.

To summarize, the loss of efficiency is not worth it and decentralization costs are too high for the user application.

Yes and often, the regulator will not even care about reverting transactions. He will simply fine the team behind the ICO for example. There are lots of situations where a blockchain is simply useless. There are better technologies. The use cases that are not Bitcoin but that do have value are limited and were identified a long time ago : token exchanges for example. For that application, blockchain may be interesting. And even then, even if they share the censorship resistance of Bitcoin (they can be traded on a free network), they are lacking the unique monetary policy of Bitcoin.

The Fall of Bitcoin

Could you picture ourselves 10 years in the future and no one is talking about Bitcoin anymore. It vanished from Earth and people are ashamed to have been implicated. What happened ?

Honestly I don’t think it is possible. In 10 years it will still be there. It can not disappear. Even the worst shitcoins are still there. Some had major bugs, some were down for a while, everyone knows they are broken and that they are scams and still, there is still a network. You can not kill a network even if it is the worst.

Let’s imagine that Bitcoin has become the worst. There are only a few nodes left. Something major took down the network and shattered its utility. What would be that kind of criticality ? Is that something you can envision ?

It all comes back to the question of what is Bitcoin. It is a bit of word play but Bitcoin is the money, is the network and is an idea. There a lot of aspects. It depends on what you pick as Bitcoin. If you look at the monetary policy, it will not change. It’s always the same rules, there will be 21 millions bitcoins. Regarding the ideas, it did not fundamentally changed. Regarding the code, there are changes. Those are always made backward compatible. In general when we envision a catastrophe scenario, this is where the danger lies.

And this gets hard to imagine because the code evolves in a really cautious way so that no major bug is introduced.

Event then, it comes back to asking the question “When Bitcoin network will not bear its name because it evolved ?”. There are people talking about adding confidential transactions, Schnorr signatures and those kinds of things. It is similar to when there was the Bcash fork, some will want to say that it is not Bitcoin anymore.

The biggest hashrate and node count will be law.

Yes and Bitcoin will still exist. There exists such a fundamental network of people, the holders of last resort or whatever we call them. They will always be there. There is a floor below which the network will not drop.

Let’s now imagine that there is a huge offensive on the miners across the world. The hashrate suddenly drops and the block time becomes very long meaning the next difficulty adjustment is unrealistically far away. Could that be a vulnerability ?

That would be a temporary problem. It would work the way it is designed. If the hashrate drops suddenly, the difficulty would adjust in the next two weeks more or less. However if you are talking about a cataclysmic drop, yes it gets complicated. You can also envision other scenarios like “What happens when there is no internet ?” or “What happens if everyone goes to jail ?”. Most of the scenarios where the Bitcoin network can not be used anymore are such major scenarios.

Like generalized censorship, autocracy or Internet shutdown.

I don’t see any scenario where Bitcoin is under such threat while you do not already have major other problems. Take for example quantum computing where breaking the cryptography of the whole internet gets unlocked, this is a bigger problem than Bitcoin. In all those scenarios, Bitcoin will most likely be the least of your concern.

However, scenarios where the world stays more or less the same, where not all the people go crazy at the same time AND Bitcoin has a problem are less likely. Give a look at the ecosystem and how it works. Are you familiar with the concept of Antifragility ?

Yes I read Taleb’s Incerto. I precisely want to write about it. It is important literature.

Antifragility

Bitcoin is really antifragile. What we saw with time is that the more the attacks, the more the network adapts. It is one that adapts the best and the most. Whatever will happen, it will adapt. If it really fails, it will evolve. It is natural selection.

In a sense we can imagine Bitcoin as the first living digital creature. It is an entity living on the networks with its own life mechanisms. It evolves and feeds on the world energy. It is replicated everywhere, much like a virus.

Yes it is like a virus, a living organism. It has most likely no conscience. I see it a bit like an organism living on the web.

It’s funny though, it is like a creature that communicates with humans and humans talk with it.

It is like companies or societies, they also are a form of organism. What is peculiar about Bitcoin is its scale and deployment as well as its survival mechanism.

Another particularity of that organism compared to other companies is that the entry barriers are almost non-existent. Anyone with an Internet connection and a smartphone can potentially run a node and join the network. Meanwhile it is harder to be part of the other living organisms on the Internet : think about Facebook that is only maintained by Facebook. Hence its diffusion power is greater due to its easiness of access. It is still technically complex for a newcomer but regarding hardware, you can run a node on a potato. We can imagine a future where there is a node in every phone.

Yes and what is also original about the Bitcoin idea is its game theory model and all the incentives around.

True, you are inclined to enter the network and the more you are in, the more people are in.

An individual will enter for whatever reason pleases him: being a miner, a user, whatever. There are similarities with other networks such as Bittorrent. However that network required people to share just for the sake of sharing. Relying on benevolence is not indefinitely sustainable. Meanwhile the Bitcoin idea is sustainable because there is an incentive, whether for usage or pecuniary reasons. People willing to invest or use it have skin in the game. They are not rewarded with fees like the miners but it is a product that interests them, that they want to use. Everyone has his own interest in participating.

Even in a egoistical or individualistic way, everyone is still winning. For example : I write an article about the subject, this may lead other people to question the subject. So in a sense I am myself feeding the network.

Yes everyone has its reasons.

It could for example be one’s curiosity that brings him in. I started running a node at my home because I was curious and willing to understand and in the meantime I support the network.

Mexican Standoff

We talked about incentives and game theory. Do you have an opinion about nation states entering the game. The first one to play wins. What is to prevent them to join ? The experimental aspect of Bitcoin maybe ?

I think we will see that more and more. It is very complex because a nation state is vast and inhomogeneous. There are a lot of subdivisions and different circles of powers : the central bank, the government, the counties, the towns, etc. For example in the US, the Fed is supposed to be independent from the government. There are also many ways for a nation state to acquire bitcoins. When Peter Thiel supports mining in the US, the US are in a sense acquiring bitcoins via the private sector (link).

Regarding the central bank reserves more specifically ?

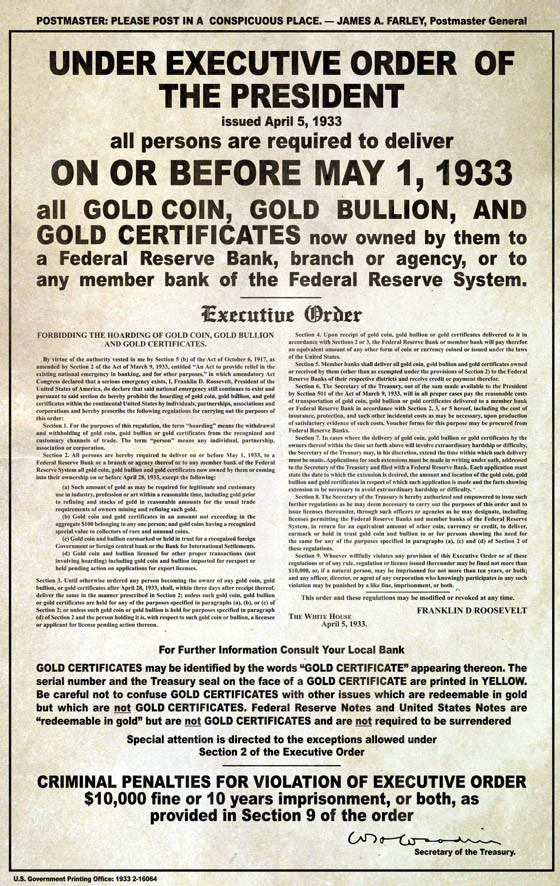

This is more obscure. It is for example very hard to asses China’s gold reserves, you can only guess. The central banks actions are rarely clear and never will be. The strategies are opaque. Moreover depending on the country, what belongs to the citizens indirectly belongs to the state : we saw in the past gold seizures in the US or in France.

This could be the case in Canada for example, the government could require citizens to deliver their bitcoins.

Yes and it has been done in the past with gold. There are many things we can think of. It is hard to predict the future. Bitcoin idea is also to replace central backs. They face a dilemma : will we go with the money that makes most sense but encourage this system which is direct competition to our authority ? Their first mission is to preserve themselves.

Gold was seized in the aftermath of the 1929 crash - Source

But even then it will fundamentally not change a single thing to Bitcoin’s operation. It is hard to know what banks will do : it may change depending on the governments and they don’t know themselves what they’re doing.

You raise a good point. Understanding Bitcoin with a technical, economical and historical perspective is not an easy path but it is mandatory to grasp the whole thing. Few people have come to a deep understanding of Bitcoin with all these aspects in mind. Hence it makes a lot of sense that a governmental entity divided in many sections and sub-entities will have a hard time grasping the subject and coming to a decision.

Even without Bitcoin, they do not necessarily know what they are doing. The idea that they understand how economy works is just nonsensical.

If you do something, it has influence everywhere. You may have an idea on the short term of the impacts but long term it is certain that there is no control. They see the economy as a machine and think that it is under precise control. Well, it is not the case and never will be. Fundamentally, their work is bound to fail. Bitcoin or not.

To conclude before you get back to work. What is your current challenge ? What are you hitting your head against ?

There are many small subjects. Overall, there is no main problem except time. I am thinking about projects I have put to the side but would like to explore. It is mostly a timing problem.

What is cool with Bitcoin is that it is really concrete. The idea that government and central backs are bad was historically a theoretical debate. Here we work on it. Imagine that you want to fight against the Fed before Bitcoin. You would have had to go through politics, win elections and change the law. In practice it is really complicated. With Bitcoin, you ask permission to no one and you don’t have to go through a democratic process where the whole 50% of the population has to agree. You just have to do it and put people in front of the fait accompli. It was similar with illegal downloading.

Those kind of process can be broadened. The projects I am thinking about are linked to that idea developed with Bitcoin: “sometimes if you want to push ideas, it is better to do it in practice, ask no permission and build”.

One problem with Bitcoin is that we hyper focus on it but if you look in the subjects of economic freedom and individual freedoms, there are lots of things that deserve this kind of approach. The question really is “How to use technology to help people and to support freedom ideals” ? This is more what I would like to dig in but I do not have much time right now.

Time, the ultimate resource.

The second rarest thing after Bitcoin.

Or before we don’t really know.

It’s a bit the same thing.

The question remains open.

Interlude

At that moment we almost went each on our way but Vincent asked me what lead me to Bitcoin and the show was back on.

In short, I got interested in august 2017. I saw the bubble rise and pop. I gained and lost money. I stayed and started digging the subject more in depth. The more I tried to understand, the more I discovered. With time I built links with other fields of study such as history and economy and it kept getting more and more interesting. It has been more than two years and I am still learning.

Back to the interview.

Empiricism Versus Theory

People who think Bitcoin will disappear. They totally missed the thing. Bitcoin already won. It is a fact.

It is hard to understand but I agree with you when you said at the meetup “What has been done, can not be undone nor can it be redone”. The code is free, it is available, the idea is out. The idea of building an alternative exists. If the solution is better than the rest, it will prevail.

It is not a mere idea, it goes beyond. The idea to compete with central banks have been present for a while. Putting the idea in practice is the novelty.

It is similar to the idea of intrinsic value. Some people say Bitcoin has no intrinsic value because it is digital or you can not make a ring out of it. They are wrong. It’s been out for 10 years, it’s been priced for 9 years. People can say it is worthless in the idea realm. If you stay in the idea world, it is easy to say that you can not compete with central banks, that the Canadian Dollar is worth something, that Bitcoin has no intrinsic value. Well no.

You can see how the narrative evolves. There was a time the saying was that bitcoins were like tulips : it is a bubble, it will disappear and we will never hear of it anymore. It was completely contradicted, it still exists. What’s cool with Bitcoin is that if you do not want to argue, you don’t need to. People can say Bitcoin is dead, that it is worthless. In the end, I can still use it to invest or to transact. What they are saying has zero impact on its usage. If people want to stay in their bubble, good for them.

Am I Crazy?

Last question, do you sometimes think you are crazy ? When I read about Bitcoin, everyone seems to agree. Sometimes I wonder if the bitcoiners are not all crazy ? Sometimes I wonder if I am not crazy myself.

I am living a bit on both side. Most of the people I share my life with are more or less interested in Bitcoin because they know I am in it and sometimes we discuss the subject. But it is not Bitcoin only.

On the other side, the projects I am working on are 100% Bitcoin. I am not in it 100% but I know people who have no connection with the outside world and who are living 100% in it. I have lots of contacts not in Bitcoin and I generally do not too much proselytism outside of the Bitcoin universe. I like seeing how normal people evolve with regards to the Bitcoin idea.

Now I have reached a state where I think the rest of the world is crazy. I know it’s the case. There was a moment in the beginning up to 2015-2016 where it was very underground. It was darkweb, extremism etc. People interested were very a small minority. Back then I could wonder if I was crazy or not even if I thought I was right. But now many regular people are getting interested and you see people changing their mind progressively.

I know no one who has been into Bitcoin and who ended leaving. No one I know said “Yeah I worked in Bitcoin then I stopped, I don’t believe in it anymore, it will never work, I prefer Canadian Dollar” while the opposite happens every day. There are enough cases of people getting interest in Bitcoin/crypto, exploring altcoins then coming back to Bitcoin to say that it is almost a classic. There is nothing extraordinary, those people are not all crazy. People from many different backgrounds follow the same journey. It is more a question of how much time before it happens.

It is a one-way ticket. It is hard to come back after you reached a deep understanding about the subject: it becomes hard to say “Oh well finally I disagree with what I learned”. What helps is that Bitcoin is constantly under critics and faces a lot of skepticism. Bitcoiners had to analyse deeply the critics because they have skin in the game. They can not mess up. They all need to know if there is an error in the system. The more the critics, the more their thinking sharpen and the less the weaknesses in the system.

A Lie Detector

It also reveals people’s fundamental ideas. There are people who will understand Bitcoin very well but will not adhere because they oppose the ideas behind. For example, China central bank or other governments may oppose Bitcoin not because they misunderstood but precisely because they understood. There are people who dislike Bitcoin very much because it stands against their interests or because of ideological reasons. Fundamentally behind Bitcoin there is this idea that people are free and responsible, there is this idea of freedom behind it. There are people who do not want that.

Just like Congress representative Brad Sherman who’s truly on point : Bitcoin is a threat to the hegemony of the US Dollar and consequently the political power of the US (and by extension of all governments). [see video]

Bitcoin decreases the central bank power. Borrowing to wage war will be more difficult. The more we go, the more this will be true. This will be a good side of Bitcoin I believe. If there is one of Bitcoin’s two aspects, censorship resistance and hard monetary policy, that you don’t like, you will have to explain what bothers you in the fact that someone transacts with anyone freely.

One would argue by saying that it is to fight against terrorism since we all know there was no terrorism before Bitcoin and only Bitcoin is used to finance terrorism.

Some other people will simply prefer for every transaction to be traced like they do in Sweden.

Yeah I find a bit scary the idea of total surveillance of every citizens transaction.

They will say it is for preventing money laundering, to fight terrorism. They will be obliged to say “We want to see everything”. At that moment people will have the opportunity to say “Nope, not interested”. This is the greatest Bitcoin’s lesson: you can build your system in parallel to what exists. It’s also about balance, to what point will the government want to fight against Bitcoin. They will not kill people who want to use Bitcoin. Even then, people will organize.

The future may take lots of paths.

I remain rather optimist. It’s a bit late to stop something Bitcoin. Some government may go hard on it but some other will be more friendly and will drain people and businesses. In the long term, it will profit Bitcoin. What about you ? Working on some project ?

Sure. I write and share things and we’ll see where it goes ! I think it will be exponential. At first there are two or three articles and 25 people read them. I believe the gap between 0 and 1000 will be the same as the gap between 1000 and 10 000. I’d like to provide a launch platform for people who would start from zero but want to learn many things about complex subjects in a simple way. The ideal audience is the person who thinks “Ok I know nothing about anything but I am interested, where do I start, where is the info, what books should I read ?” A bit like the path I followed on my own. I want to offer that to people : “I read those books in that order then it lead me to think that, this is what I got out of them”. This is the first step.

That’s useful.

Thanks my objective is to have one reader who deeply enjoy that. And it seems I succeeded ! R. wrote me a kind message. My work here is done.

Hold on, it is a long process.

Sure !

Thank you for reading.